Citibank and Comcast demonstrate two awesome ways to fail in public

It’s been a rough 12 months. It’s been a rough week, if you’re anywhere in the US with weather. But you know, it’s still a good time to review your processes, because now that there is an Internet and social media, your failures are visible to everyone. Just ask Comcast and Citibank.

Comcast Cares about your streaming porn

When Comcast implemented the @ComcastCares Twitter account more than a decade ago, it was a breakthrough in customer service — you could get directly through to a human when things went wrong. Now, of course, it’s just part of the corporate service mechanism. except that it’s done where everyone can see. And sometimes that response is a little embarrassing.

Barry Petchesky and his 60,000 Twitter followers saw a simple little tweet about how the Russians sent back photos from a probe on Venus — obviously to tie into the incredible pictures coming from the Perseverance rover on Mars. But what followed wasn’t quite what he expected. Here’s the Twitter thread.

Thank you, “Sweatpants” with your 26 followers and your crappy Twitter account, for showing us what’s really happening inside Comcast customer service. And to “AD” at Comcast: please don’t push that automated response button on Sprinklr without reading the tweet first.

Citibank wires $900 billion by mistake — and won’t get most of it back

Meanwhile, we just learned that due to a terrible user interface, a Citibank contractor just wired $900 billion million of Revlon’s money to creditors. Citibank was supposed to be wiring the money, but only $7.8 million. Then somebody checked the wrong checkbox and sent the full principal amount instead of the interest.

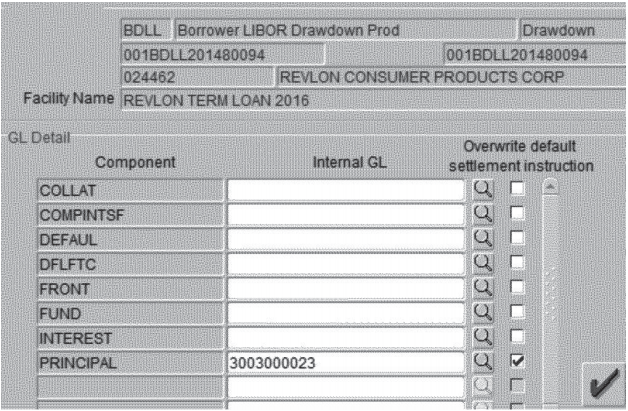

Here’s the interface on the “Flexcube” application that the Citibank employee was using:

That looks about 25 years out of date, doesn’t it? It also works in a confusing way.

A transaction of this magnitude required approval from two workers in India, including the one who made the original mistake, and a senior Citibank official in Delaware. All three were confused enough to cost Revlon and Citibank nearly a billion dollars.

Somebody, somewhere, has made a decision every year not to update Flexcube. How much do you think it would have cost to update? I’m guessing, less than $900 million.

Can you say technical debt?

Next time you’re setting up systems and processes, consider that the cost of your decision may not just be making it hard for workers to do the right thing easily, but that their mistakes may be on view for all the world to see.

Josh,

I think you inadvertently demonstrated how easy it is to make a simple mistake. You said a Citibank contractor wired $900 billion. No harm done this time, fortunately.

Ha! Good point, Jack! Only off by a factor of 1,000.

Good one, Josh! Thanks!

Re Citibank and their seemingly antiquated payments interface in particular. Both public and private behemoths are giant tails wagging equally giant dogs facilitated by parasitic intermediaries (corporate fleas such as SAP, DXC etc) “consulting” on how best to implement global, system-wide changes. I have the pleasure of using a Aust gov’t based portal system to lodge certain data. The only access point (unless I have a significant, direct EDI) is via a web browser. I must have a digital certificate to use this system. I have been using this system since 2007-ish. There is only one web browser that I can use. Do you see where this is heading? Internet Explorer. Yep. V11. Taken out of public support by MS in Jan-20. Yet it is still a mandated software programme by Australia’s federal govt to access a critical data system. Apparently, it has something to do with the digi-certs and receiving encrypted emails into Outlook. Obviously no one has heard of block chain technology or, lo and behold, won’t budget for the upgrade. I’d bet dollars to donuts that there are any number of banks and govt agencies around the world still using legacy systems on XP or even Win 95 as “if it ain’t broke, don’t fix it”.