The Rationalist Papers (24): Tax returns

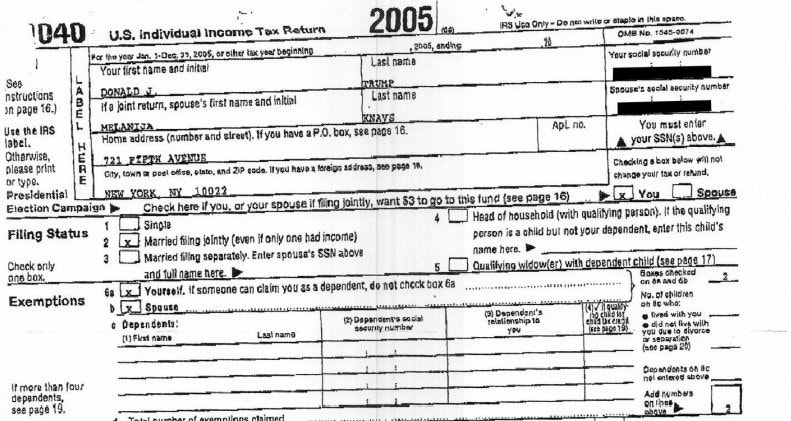

Every presidential nominee since 1976 has released his tax returns, or at least a summary of what’s in them. Joe Biden has released 22 years of his tax returns. Donald Trump did not make his returns available in 2016, and has not released them this year, either.

Does this matter?

Just a reminder: these Rationalist Papers posts are for the group I call the deciders: conservative, moderate, undecided, and third-party voters considering their choices in the 2020 US Presidential election.

What do tax returns reveal about a candidate?

Tax returns do not reveal everything you’d like to know about a candidate (if only!). For example, they do not reveal a candidate’s net worth. But they do reveal key facts including:

- How much income did the candidate make?

- How much tax did they pay?

- Where did the income come from (e.g. speeches, investments, books, consulting, businesses, wages, or real estate)?

- What deductions did they use to reduce their taxable income?

- From whom have they borrowed money?

- Do they have foreign bank accounts?

- Do they have foreign investments and have they paid foreign taxes?

- How much did they give to charity?

Crucially, the accuracy of the facts within a tax return are guaranteed by the candidate signing the return. Lying on a tax return or concealing income is a federal crime and the IRS has the resources to enforce the laws against tax fraud.

Trump’s excuses for not releasing his returns don’t hold water

Trump says his returns are under audit, and for that reason he cannot release them.

This makes no sense.

If he released his returns, they would become public. But the IRS already has access to his tax returns, and the power to compel production of documents related to them. Releasing his returns would not give the IRS access to anything it doesn’t already have, and would not strengthen its audit case.

What would happen is that the news media would get access to the returns and would write about Trump’s business dealings.

The New York Times says it has copies of his returns and has already written an extensive series of pieces about his finances. Among its major findings:

- Mr. Trump paid no federal income taxes in 11 of 18 years. In 2017, after he became president, he paid only $750.

- His audit regards a disputed $72.9 million deduction.

- His main businesses, including golf courses and hotels, are major money losers.

- He has personally guaranteed hundreds of millions of dollars in loans. (Who does he owe?)

- He declared some odd deductions, including $70,000 for hairstyling.

- He distributed hundreds of thousands to his family under the guise of questionable “consulting fees.”

None of this is, per se, illegal. But it is exactly the kind of information that publicly revealing tax returns would allow us to see.

Trump has offered explanations. For example, in last night’s debate, he said the explanation for his low tax payments was that he “prepaid” his taxes. (Tax experts were mystified by what this actually meant.) But there is no way to verify his statement without seeing his returns.

A Trump Organization’s lawyer reviewing the Times report told the newspaper that “most, if not all, of the facts appear to be inaccurate.” But there is only one way we, the public, could be certain — which would be if Trump, like every other candidate, released his returns.

Trump says he has released detailed financial information in financial disclosure forms required of all government officials. But the returns include information that would never be visible from such forms. And unlike tax returns, there’s not much risk from lying on financial disclosure forms. For example, presidential advisor and son-in-law Jared Kushner filed incorrect information in disclosure forms 40 times, which he had to correct. No one is prosecuting him, because it’s not tax fraud.

If Trump were to release his tax returns, media of all kinds would dig into the records. For every accusation by the Washington Post, there would be a counter-argument by Fox News. But we’ll never know, because we didn’t get to see the returns.

Even if the audit were to end, do you think we’ll get a look at the returns? See if you can guess, based on on Trump’s past behavior.

Seems unlikely.

Trump doesn’t trust you.

In describing his nuclear disarmament treaties, Ronald Reagan adopted the principle of “trust, but verify” — and used it to add measures to the treaties that would allow both parties to prove they were abiding by it.

If Trump wants us to trust him, we need to verify what he is saying. That’s why candidates release tax returns.

But Trump doesn’t trust us with his tax return information. He doesn’t want you to know what’s in his returns, how well his businesses are doing, and to whom he owes money.

A candidate that the Washington Post’s fact checker says has lied more than 20,000 times now wants you to trust him.

If he doesn’t trust you, can you trust him?

Ok, this hurts me. A lot. But,

I can understand Trumpet’s stance with respect to the taxes and audit situation. Were he to release his taxes and then the audit required him to change what he said in them and/or what he paid:

1) He’d look like a liar, and would get heavily called out in the press for his lying – and we all know he doesn’t handle that well.

2) He would be seen (another time) as being an incompetent business person, except in the sense of “hey, it’s legal to use loopholes to not pay as much in taxes as someone who can barely afford rent and food, but still has to pay more in taxes than I do.” But that would make him look crass and like a cheat, neither of which are good optics, and he knows it.

3) The business info available from his taxes might be perceived as showing conflicts of interest he could be under as President. And, because I’m guessing he thinks there are no such conflicts, that would also be bad optics for a candidate for POTUS, or a sitting POTUS.

4) The business information available from his taxes could actually sour business deals he/his business have in progress. This because (a) his recent taxes might actually be related to still-ongoing deals and (b) because the kind of people he deals with don’t like their own business dealings in the public eye, so since future dealings with DJT would entail transparency, well, they’d pass.

So, the easiest thing to do is lie, obfuscate, delay, etc., because he’s willing to take a risk that his supporters will be willing to give him a pass on release of his taxes since he promises other things (i.e. the ends justify the means).

That’s pretty insightful, Tim. Thanks.