The Rationalist Papers (18): Biden will raise taxes. But not on you.

Yes, taxes would be higher under President Biden. Enough to raise $2.4 trillion in the next ten years.

You almost certainly won’t be paying them, though, unless you make more than $400,000 a year or run a decent sized business.

Just a reminder: these Rationalist Papers posts are for the group I call the deciders: conservative, moderate, undecided, and third-party voters considering their choices in the 2020 US Presidential election.

That’s the analysis of the Urban-Brookings Tax Policy Center, a nonprofit, nonpartisan think tank that does independent analysis of tax plans, scoring them based on historical income levels, tax levels, and tax payments. The Tax Policy Center is one of the last uncorrupted resources left in DC, with a politically diverse collection of tax geeks whose models of the effects of taxes are the best, most balanced estimates available.

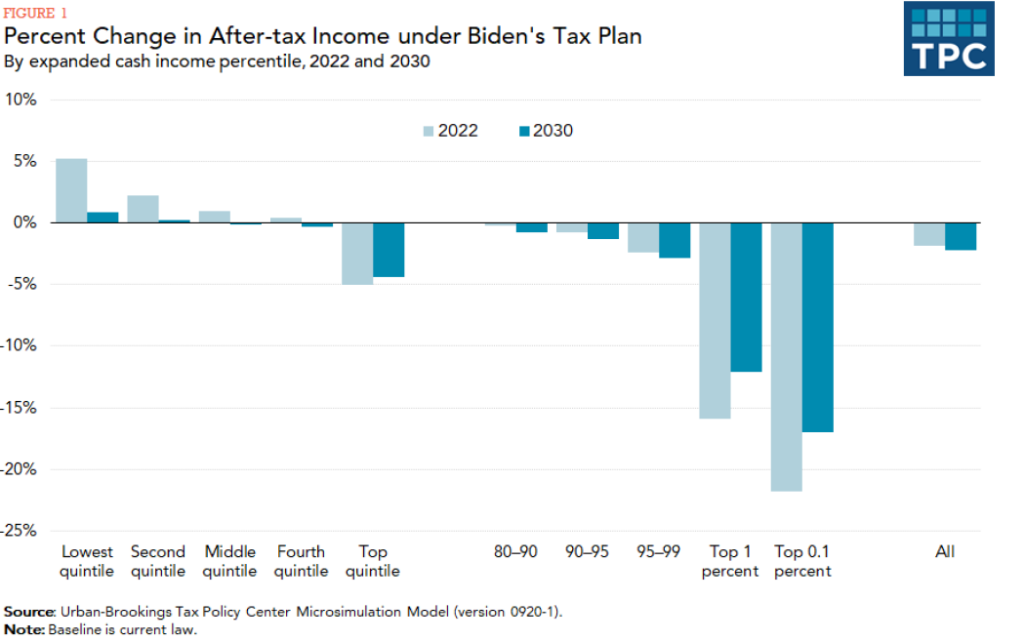

When the Tax Policy Center analyzed Joe Biden’s most recent tax plans, here’s what they found.

Taxpayers in the lowest 20% of earners ($24,800 or less) will see a 5.2% increase in after-tax income.

Taxpayers in the next 20% (up to $49,800) will see take-home pay increase 2.2%

Those in the next 20% (up to 88,500) will take home 1.0% more.

Those in the next 20% (up to $159,800) will clear 0.4% more.

Only the top 20% of taxpayers will see a decrease in after-tax income (5.0%). The top 1% will see incomes drop by 15.9%. And the top 0.1% will see after-tax income fall by 21.8%, paying an average of an extra $1.6 million each.

If that’s you, then thanks for taking time out of your cash-rich existence to read my blog, and we appreciate the contribution to the economy. The top 20% of taxpayers will account for 137% of the new revenue raised — because everyone else will be paying a little less.

Here’s the key chart, which shows the impact on taxpayers at different income levels:

What is likely to change?

Trump talks about Biden and Democrats “doubling and tripling your taxes.” That’s completely distorted, unless you’re making all your money from investments and you’re very rich. Biden’s taxes are designed to tax three big sources: people who earn more than $400,000 a year, people with a million dollars in income who get money from capital gains, and businesses.

What are the biggest changes that Biden is proposing? Here’s a list, along with the amount of money they are likely to raise over 10 years, according to a team led by Tax Policy Center Senior Research Associate Gordon B. Mermin:

- Increase the corporate income tax rate from 21 to 28 percent ($730 billion)

- Increase minimum taxes on foreign-source income of US multinational corporations ($710 billion)

- Apply Social Security payroll taxes to earnings above $400,000 (raising $740 billion).

- Repeal TCJA [Trump’s Tax Cuts and Jobs Act] individual income tax cuts for taxpayers with incomes above $400,000 ($310 billion)

- Limit the value of itemized deductions for taxpayers with incomes above $400,000 ($220 billion)

- Increase taxes on capital gains and dividends for taxpayers with incomes above $1 million ($370 billion)

- Increase the estate tax ($220 billion)

What does this mean?

The Republican talking point is that increasing corporate taxes causes companies to cut jobs and wages. The evidence of that is not clear. The more worrisome trend is tax avoidance by shenanigans involving recognizing income overseas — which is how companies like Apple avoid paying billions of dollars in taxes. But the provisions of the Biden tax plan would end those strategies, so big profitable U.S. companies would finally pay their fair share of U.S.

It means the social security trust fund won’t run out of money as baby boomers like me retire, because rich people will be paying into it.

It means people who make more than $400,000 will get into the tax bracket they were in before Trump’s tax cuts. The top tax bracket will go back up from 37% to 39.6%. Shed a tear for them.

And it means that people who make lots of money from stocks and bonds won’t get a preferred tax rate — and won’t be able to easily avoid taxes when they die and attempt to pass on their wealth to their children.

In case you are wondering, this is not going to be the end of innovation in America. Investors in startups will still make a crapload of money, just not quite as much. People who make lots of money as entertainers or athletes will still make a crapload of money, just not as much. Most of the capital earned by these types is sloshing around the financial system, not resulting in investments that generate jobs and income. They’ll do fine.

As Len Burman, an Institute Fellow at the Tax Policy Center and the Daniel Patrick Moynihan Professor of Public Affairs at Syracuse University told me, “There are lot of factors that go into economic growth. Rising income inequality is not good for growth. A sense of social connection and involvement in the economy makes people more inclined to participate fully.”

There’s one more reason to like this tax plan. It invests billions of dollars in IRS enforcement, with face-to-face auditors. The Tax Policy Center estimates that better enforcement would net $35.7 billion in revenue over ten years. More importantly, it would make it far more likely that tax cheaters would caught, which would reduce the rate of cheating.

I think people who cheat the tax system hurt all of us. They ought to go to jail. Don’t you agree?

Is the quote from Len Burman correct? Is it income equality or inequality that is not good for growth?

He said inequality. I made a typing mistake in quoting it wrong. Thanks for catching that.

It is true that Biden offers a more rational tax plan than Donald Trump. Having said that, neither candidate nor party offers a longer-term plan that reconciles America’s spending and revenue generating behavior. Without contributions from the middle class, the Biden plan merely places a finger in the flood gate.