Your regular, daily bullshit: financial markets news

Every single day, the Wall Street Journal and other financial news outlets publish a financial wrapup. And you can count on it including a healthy helping of bullshit every day, too.

Every single day, the Wall Street Journal and other financial news outlets publish a financial wrapup. And you can count on it including a healthy helping of bullshit every day, too.

Here’s the problem: the numbers are facts, but news requires a “story” to wrap around the facts. Creating a story from the fluctuations of the market is difficult, especially every day. What makes it worse is: every bit of information you could possibly use is already priced into the market.

The result: financial wrapups (and most of what else you read in the markets section) are stale made-up narratives for suckers.

Let’s look at a typical day’s wrapup, “U.S. Stocks Rally; Deal-making buoys health-care sector” from the 30 March 2015 Wall Street Journal.

This article is filled with actual news including market movements and mergers. But to create a narrative, the reporter Dan Strumpf adds the obligatory quotes from financial experts. And since the experts don’t want to give away any inside knowledge, and want to allow themselves wiggle room on any prediction they might get wrong, the result is waffling, warmed-over weasel words (which I’ve highlighted):

[Marc Antonellis, sales trader at Robert W. Baird said] some buyers stepped in following last week’s slide. “We got a little oversold going into months end,” he said. [Startling news: stocks went up because people decided they had sold too much!]

Shares of biotechnology stocks were among the biggest decliners last week, amid fresh worries about their lofty valuations. [Stocks went down because people thought they were priced too highly!]

Many investors will likely [whoah, a sentence that starts with both “many” and likely” — there’s a prediction you can count on] be taking a breather until first-quarter earnings season kicks off in the weeks ahead, said Larry Weiss, head of trading at Instinet. Investors are bracing for declines in first-quarter profits as the stronger dollar continues to weigh on the fortunes of multinational companies. First-quarter S&P 500 earnings are expected to decline 4.7%, according to FactSet. “We’re in a typical lull,” he said. “The focus for the next few weeks after this will definitely be on earnings.” [People will wait to see how companies do, so the market could go either way!]

“We’re going into earnings season and expectations have come down,” [Andrew Slimmon of Morgan Stanley Wealth Management] said. “That’s actually a good thing.” [When prices go down, they have room to go up!]

The main reason to read financial news is to get insights on markets. But investing based on these weaselly “predictions” is unwise. In case you’re wondering, most of my money is in index funds, and I don’t react to market news — because unless you have inside information, the market knows more than you do.

So why don’t the Journal, IBD, Barrons, CNBC, and Fox Business give it up? Because people love this stuff — it’s gossip for the financial set. But investing based on this “news” is a fool’s game.

What’s missing: tying the financial news into a long-term picture of the economy.

Could you say it shorter? Sure, just cut out the commentary. Here’s the TL;DR version:

After being down last week, the S&P 500 rose 2.5%. Shares of UnitedHealth Group and Catamaran went up on their merger announcement. European and Chinese markets were up, too. Anything else we could say is already priced into the market, so we’ll leave it at that.

For a complete set of edits on this article, see the Google Doc.

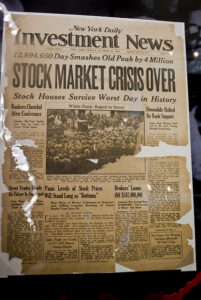

Photo by Wagner T. Cassimiro via Flickr.

One Comment