I paid no federal income tax for last year. Is that fair?

I had a great year in 2017. I’ve been pleased to be able to basically replicate the income I had as a very senior analyst working for a research company, but to control my own destiny and work hours, and work only on projects that I like. But one thing is different. My income tax bill is zero.

I had a great year in 2017. I’ve been pleased to be able to basically replicate the income I had as a very senior analyst working for a research company, but to control my own destiny and work hours, and work only on projects that I like. But one thing is different. My income tax bill is zero.

This was shocking to me. I thought it was worth explaining how this happened and discussing if it makes sense.

To help you understand how I got here, I’ll explain a little about my situation. I make my money from clients who need help with writing and editing books and other materials, along with speeches and workshops. After 35+ years of working for companies, I’ve built up a solid investment nest egg for my retirement, so every year I have some investment gains. And I have a house in the suburbs of Boston, but I paid off the mortgage with some fortunate gains from stock I got earlier in my career.

So if you look at the income on my 1040, you’d see a healthy sole-proprietor business and some capital gains and dividends. I’d expect to be in an upper-middle-class tax bracket. Except that I’m not.

How did my income tax rate get to zero?

Well, I get the usual standard deductions and exemptions for a married person with two children, which knocks $16,000 right off the top. Then I was able to subtract the following expenses.

- Business expenses. These are all fully legitimate and ordinary, like internet access, travel, legal and web development fees, office furniture, and fees paid to my book agent against money for my book advance. I also get a small business expense deduction for my home office.

- State taxes and local taxes. This totals almost $30,000 for my property tax and Massachusetts state income tax.

- Charity. I made $8,000 in charitable contributions last year.

- Fees for preparing my taxes and my investment advisor.

Then there were deductions you might not think of unless you’re self-employed and have a good tax advisor. I further reduced my income with deductions for:

- A self-employed 401(k). You may know this a Keogh. Self-employed people like me can invest a big part of our income and not pay taxes on it. I put more than $50,000 into this account in 2017 and didn’t pay tax on any of it.

- Health insurance. I have two college-age children and my wife is an artist. I pay the health insurance myself. It’s a lot, but it’s deductible if you’re self-employed.

- A health savings account. If you have a high-deductible health insurance plan, you can stuff money into this and pay medical expenses from it tax free. That’s more than $7,000 right there.

- My wife’s IRA.

- College tuition. I can’t deduct all of this, but some is allowed.

As a self-employed person you also have to pay self-employment tax (basically twice what people working for others pay into Social Security and Medicare). For me, that’s more than 12% of my business income. But half of that is deductible, too.

Anyway, after all these deductions and exemptions, my income looks much smaller.

You may have heard that the capital gains tax rate is 20%. But it turns out that’s an oversimplification. In fact, it can be less than that depending on your income. And all those deductions reduced my income to such an extent that my capital gains tax rate is 0%. Nothing.

That capital gains break turns out to be very helpful. Because despite living a non-extravagant life, I don’t just have an extra $50,000 or $60,000 of income lying around at the end of the year. I had to sell investments from my nest egg to fund the IRA and the 401(k) and get the tax breaks. Normally that would generate capital gains, but this year, I didn’t have to pay tax on those gains.

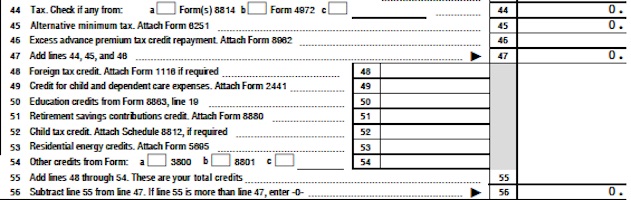

As a result of all of these deduction and breaks, the tax amount on line 44 of my Form 1040, where the rest of you are paying your income tax, is zero.

To be clear, I still needed to pay the IRS plenty — remember that self-employment tax. And of course I paid lots to Massachusetts in state income tax and to the town of Arlington in property tax. But my actual federal income tax is zero, and my effective federal tax rate (that self-employment tax divided by income) is 8.6%.

None of this is shady or unusual. It’s all following the tax code exactly and taking deductions exactly as intended. There’s no interpretation here. The IRS intends that someone in my situation should pay no federal income tax.

Does this make sense?

I think it’s fair that I don’t have to pay tax on my business expenses, since I have to spend that money to make a profit.

I think it’s fair that I don’t have to pay tax on my medical expenses or health insurance. I’m a business, and I cover this for my employee — myself.

I’m pleased that I don’t have to pay tax on money I used to pay state taxes and property tax.

I’m glad I can give money tax-free to charities. And I’m glad the IRS is willing to help with a deduction for my college tuition payments.

The IRA and 401(k) payments seem like a dodge. So does the 0% capital gains tax rate. I’m relatively old and close to the age that some people retire at. I don’t need encouragement to invest for my retirement. I certainly don’t need breaks on money my investments make.

I expect a similar situation for 2018, even if I make more money, thanks to the new tax law. And there is the 20% deduction for income from some pass-through businesses, which describes me. (It’s not completely clear which businesses it applies to at this point.)

I work hard for my income, but I have to acknowledge that I’ve been very fortunate. My parents gave me a great education and I got a tuition break in college because my dad was a professor. I was blessed with writing and mathematical talents. I’ve worked for three companies where my stock paid off generously. Nobody in my family has gotten really sick; I haven’t had to pay to take care of aging parents. My current house and the previous one have appreciated a lot as real estate prices have gone up. And I’m a white male; the only prejudice I’ve faced is because I’m a smartass.

I’m grateful for the chances I’ve had and I am proud of the way I’ve taken advantage of them. But people like me don’t need any more tax breaks. The existing tax breaks have taken a lot of effort in paperwork, but they haven’t made me behave in any way that benefits the country.

My children are going enter a country with a lot more debt. Their health care will be expensive. Their generation will carry the burden of student debt as well.

I don’t want to pay more tax. But I will, if it can make the country better off — and if everyone else does, too.

Because this zero tax bracket thing seems nuts to me.

Thank you for sharing your personal situation as an example of the inequities in our tax system. I appreciate your openness for the sake of the good.

There is nothing inequitable about this. You followed the law. Those who feel they have not paid enough are free to make a gift to the Federal government.

If we had a flat tax, everybody would pay every year because there would be no deductions.

Well played. Well elucidated.

You did nothing illegal, and nothing immoral. So good for you. I suspect I’m not the only person reading this who wonders if perhaps I shouldn’t be using your accountant/tax advisor.

But the points you make at the end of your post are, perhaps, the most salient. Our tax code should be written in a way to encourage behavior that is both good for the individual and good for our country. The growing debt and increasing costs for health care are both subjects that should concern us all.

I wonder how many readers sent a copy of this to their own tax person? I’m 3 years in as a freelancer and still learning the ropes. As always, useful information.

I gotta start doing this, I make about $96k the last 3 years as a IT analyst but am getting drilled on my taxes (about $24k) every year