GameStop stock spikes: should we shut down the talk or the trading?

GameStop is a troubled bricks-and-mortar retailer whose stock has skyrocketed based on chatter on Reddit. Is this a real problem, and does it demand a real solution?

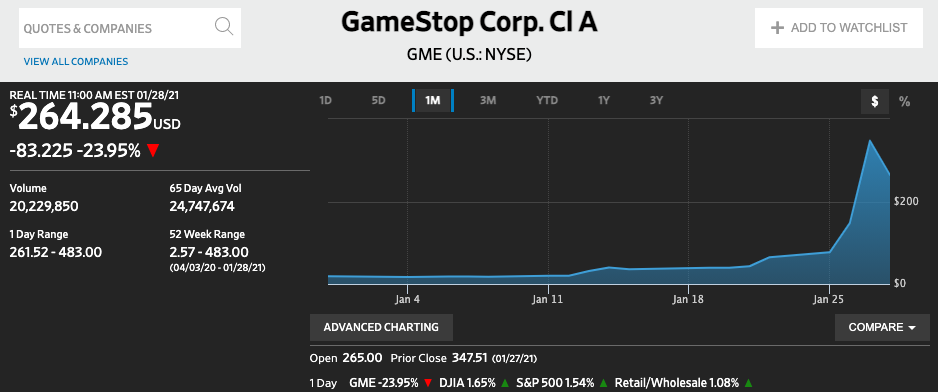

First, briefly, here’s what has happened. A bunch of wise guys, many in hedge funds, believed that because so many people now buy games online, GameStop is toast. They shorted the stock, betting it would go down. But chatter on online sites — and specifically, the WallStreetBets subreddit on Reddit — drove the stock price up. Because of the way short selling works, this “short squeeze” has created the potential for huge and spiraling losses for the short sellers, and at least one hedge fund has had to close out its position with a large loss.

It has also driven the valuation of GameStop to (as I write this) $25 billion, a valuation that has no connection whatever to the underlying value of the company. No sane acquirer would buy GameStop for anything close to $25 billion, since it has annual sales of around $6.5 billion, negative growth, losses rather than profits, and dim prospects. Its leases, mostly in malls, aren’t worth much right now either. The best account of this saga is on Ars Technica.

Now similar activity is happened on other distressed stocks, like AMC Theaters and Blackberry.

From the Wall Street professional’s perspective, this is “bad.” There are two basic narratives I’ve read: (1) This is just individuals getting in on the Wall Street game, let it go and (2) This is stock manipulation with no relationship to the underlying value of the stock, so it must be stopped. What’s the truth here? I’ll illuminate it as best I can in the form of a dialogue.

This scenario illustrates a stock whose price is out of sync with its value. Is that wrong?

By definition, the price of a stock depends on a balance between what buyers and sellers believe it is worth. In this case, the buyers driven by the urge to speculate and to inflict pain on hedge funds believe the shares are worth more. Therefore, they are worth more — that is how markets work. They work because anyone can play the game.

Absolutely, this is speculation. But all short-term stock moves are speculation. If you heard and believed a rumor that Amazon was going to buy a company, you might want to buy its stock, believing you’d get a short-term gain. The market has no way to distinguish between short-term speculators and long-term buy-and-hold value investors, and anyone with money can play.

In the long run, GameStop is going to go down, because in the long run, its value as an underlying asset is nowhere near its current value in the market. But how high will it go and when will it go down? No one knows. That’s why its called speculation.

(Should you buy it now? Nope. Not unless you like gambling when the house always wins.)

Is short-selling evil?

Markets include all sorts of obscure “derivatives” whose value depends on various moves in markets. Some of these were opaque or complex, and have contributed to economic damage like the 2008 financial crisis.

But short sales are pretty simple. If the stock goes down, you profit. It the stock goes up, you lose. Your losses are potentially unlimited — if the stock goes up by 500% and stays there, you lose five times the price of the share.

Betting against a stock is a pretty basic move. It’s a simple way to identify and correct prices inflated based on reality. If you have shares you feel are overvalued, you can sell them, but if you don’t have the shares, short selling allows you to borrow them, sell them, and then profit from that overvaluation. Here’s one defense of the practice.

Short sellers can drive prices of stocks down, but only because some “smart money” believes the price is too high. And if short sellers are wrong, they eventually pay the price for their inaccurate speculation. I’m not ready to blame short sellers for big problems in the market.

It’s certainly possible that short-selling has gotten out of hand. The cure for this is to increase margin requirements for borrowing stock. It’s short selling by people without the money to withstand losing that cause a lot of the problems.

Is this a classic “pump-and-dump” scheme?

In a pump-and-dump, speculators buy a worthless stock, spread rumors that it is going to go up, watch as hopeless dupes buy the stock, and then sell at a profit. The dupes lose money.

Pump and dump is only illegal if the promoters of it specifically “create or effect a price or price trend that does not reflect legitimate forces of supply and demand.”

The Reddit discussion is technically different from this in that the goal is, at least in part, to stick it to the hedge funds. And there is no obvious leader orchestrating the moves. It’s a classic hive mind at work in a social network.

Absolutely, the price trend has no relation to the valuation. But whether it reflects “legitimate forces of supply and demand” is arguable. The demand here comes from people who have a goal unrelated to GameStop — to punish short sellers. People buy and sell stocks for irrational reasons all the time. You may have a problem with that, but it’s hard to enforce any action against it.

Should exchanges and brokers halt trading in these types of companies?

Every trade made with short-term expectations of profit is based on some sort of inside information. Somebody believes they know something about the market that most people don’t. (If you know something almost everybody else knows, that information is “priced in” to the stock, so you can’t profit from it.)

If that inside information is secret and you act on it, that’s insider trading, and it’s illegal. It’s why Martha Stewart went to jail, for example. Of course, it still happens all the time.

In this case, the “information” on which people are trading is public. Anyone can see the chatter on these sites.

The CEO of NASDAQ says they will halt trading in a stock if they can link it to “social media chatter.” This seems dubious to me. There is always chatter about stocks and such chatter predates social media. There are thousands of stock discussion boards. Chatter on such boards is unlikely to bear any relationship to reality, and anyone who participates in the market based on it is making a very risky and stupid move.

But we cannot legislate against stupidity. More importantly, I don’t think we can effectively detect stupidity. What is the definition of suspicious chatter, and how would you identify it? More importantly, if you stopped the trading, wouldn’t you lock in gains or losses of people who were planning on making trades?

In the long term, stock prices will return to rational valuations. In the short term — well, in the short term, people without inside information generally get crushed.

The moves that NASDAQ is suggesting basically favor institutional investors and hedge funds speculating with actual inside information over poor schmoes with rumors. Is that really the function of a market?

Recently, the Robinhood app, which enables buying and selling of shares without commissions, blocked further purchases of some of these volatile stocks. As the company stated:

We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK. We also raised margin requirements for certain securities.

This also seems questionable to me. Why is Robinhood restricting access to certain stocks? I think their choice to increase margin requirements makes sense, but if you are a trading platform, you have to let people trade — including stupid people and speculators.

Should we shut down speculator discussion?

It’s easy to imagine that the solution is to just shut up the people boosting the stocks. If there’s no talk, there’s no runup, right?

Certain types of speech on such sites are illegal in that they violate securities laws. But once again, as with all discussions of social media, the platform is not held responsible for views posted by users. Securities regulators can go after any individuals who are illegally participating in a dump-and-dump scam.

The decision for the platforms themselves is one of policy. It’s certainly fine if a platform decides that it will not host speculative stock sites as a matter of policy.

In this case, one platform, Discord, actually did shut down a stock speculation server, but the reason was because of hate speech, not stock speculation chatter. Here’s their statement:

The server has been on our Trust & Safety team’s radar for some time due to occasional content that violates our Community Guidelines, including hate speech, glorifying violence, and spreading misinformation. Over the past few months, we have issued multiple warnings to the server admin.

Today, we decided to remove the server and its owner from Discord for continuing to allow hateful and discriminatory content after repeated warnings.

To be clear, we did not ban this server due to financial fraud related to GameStop or other stocks. Discord welcomes a broad variety of personal finance discussions, from investment clubs and day traders to college students and professional financial advisors. We are monitoring this situation and in the event there are allegations of illegal activities, we will cooperate with authorities as appropriate.

My opinion is this: you can’t ban stock talk. A platform can decide to host it or not, but in the end, there will always be stock chatter.

I support platforms’ decisions to ban hate speech, incitements to violence, and inaccurate information about health and safety. But it’s quite a reach to extend those bans to somebody who says “Buy GameStop and stick it to the Hedge Funds.” If you buy stock based on that, the problem is with you, not with the platform that hosted the comment.

Should we do anything?

For the most part, we shouldn’t do anything. Lots of people will lose money as a result of this activity. They are, for the most part, speculators, hedge funds, and stupid credulous people. I see no reason to change speech or trading rules to keep them safe.

If you’re reading this, don’t speculate with money you can’t afford to lose. Don’t buy GameStop or AMC or BlackBerry hoping to stick it to a short seller, because by now, the person you’re most likely to hurt is yourself. Don’t imagine that you’re smarter at market timing than the entire market — because in the end, the smart money and the algorithms will catch up to whatever you imagine your advantage is, and you will lose.

It’s a sideshow. It won’t bring down the financial system. People will get smarter about it, and it will pass. Enjoy the show, and keep your money in your wallet — or in investments you’re willing to hold for a while, in companies with prospects for actual profits and growth.

I agree that “For the most part, we shouldn’t do anything.”

However it is quite possible that the new Administration will not let this crisis go to waste. There is a huge regulatory risk to the options market and short selling. The simplest fix would be to impose a stiff transaction tax on options trading and short selling, thus using equities to attain equity through redistribution.

Ther public policy logic is that you should tax behavior deemed against the public interest, not those viewed as in the public interest.