Financial strategist market forecasts are worthless, but not useless

In Sunday’s New York Times, Jeff Sommer complains that financial strategist forecasts for market returns are terrible. They are. But they are a little better than guessing. And they have value nonetheless.

Sommer’s critique

Sommer thinks the forecasts of economists and financial strategists are way off. Here’s his critique:

[T]he stock and bond markets are swinging haphazardly, like a weather vane before a storm, as the news about the new [Omicron coronavirus] variant blows one way or another.

That isn’t stopping economists and market strategists from issuing precise forecasts for the year ahead. Wherever the pandemic may be heading, it is crystal ball-gazing season again on Wall Street.

It is the time of year when forecasters fire up their algorithms and release streams of projections that will tell you precisely where the S&P 500 will close in 2022, where the 10-year U.S. government bond yield will end up and how high the inflation rate will be.

There are myriad forecasts with specific numbers — and if any of them turn out to be correct, it will be an accident. Year after year, market predictions run headlong into a basic problem: It’s simply impossible to forecast the economy or the markets with accuracy and consistency, as many academic studies have shown — and as I’ve pointed out in previous Decembers.

Sommer’s analysis from last year said that Wall Street forecasts since 2000 were off by an average of 12.9 percentage points.

How bad is that, really?

Analyzing historical stock market data

Let’s look at the history of the S&P 500, an indicator of the broad market that has been around for nearly a century. (I know my financial advisor, who is likely reading this, will tell you that the S&P 500 is subject to various distortions, but for the purposes of this analysis, it’s a pretty good proxy for “the market.”)

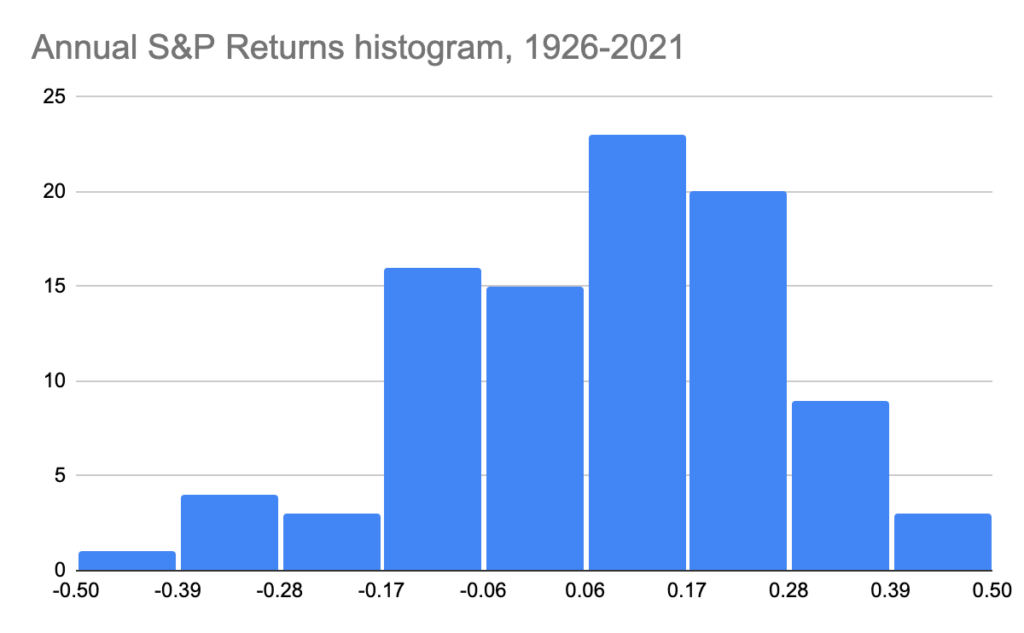

Since 1926, the S&P 500 has bounced around considerably. It was down 47% in 1931 (eek!) and up 47% in 1933 (woohoo!). Since then it’s hit just about every number in between. Here is a histogram of S&P 500 annual returns since 1926.

The average annual return is 7.9%. On this chart, that would put it inside the tallest bar, the one that starts at 0.06. The standard deviation is 19 percentage points. That means that if you want a 50/50 chance of guessing the return properly, you should guess it will fall into a range between a 5.4% loss and a 21.2% gain.

That’s a hell of a broad range — and even then, you’d only be right half the time.

The number of things that can affect the return is infinite. Pandemics are just the beginning. Severe weather, political upheaval, war, supply chain disruptions, mergers, actions of hedge funds, legislation passing or not, changes in tax rates, revolutions — all of these could happen, all of them could affect the market, and none of them are predictable.

Financial strategists have data. They know the P/E ratio (price to equity) of the market, which can show if the market is over- or undervalued compared to historical norms. They can examine trends in unemployment and inflation and growth in gross domestic product. They can make guesses about some political factors, such as whether or not Biden will pass the Build Back Better act or who will win the 2022 midterm elections. They can project what’s going on with the Fed and other central banks, which strongly affects stock returns.

This allows them to make an educated guess. How good is that guess?

I noted Sommer’s data showing that the average forecast in 2020 was off by 12.9 percentage points. If, instead of following the market trends and projections, you had just guessed the average annual return for the S&P’s run — 7.9% growth — every year since 1926, your guess would be off by an average of 15.3 percentage points.

So the data shows that the Wall Street forecasters are better than just guessing. But only slightly better.

Worthless but not useless

Sommer pinned down some of those forecasters. What they had to say about those forecasts was fascinating.

Olivia Frieser, the global head of strategy and economics research for the bank [BNP Paribas], said: “These are our best efforts in having a framework and giving our views” to clients, who want to know what the strategists think.

Marcelo Carvalho, the head of global emerging markets research, went further. “The numbers are meaningless in a sense,” he said, and continued, with an engaging smile: “Whenever I make a forecast, and I have done this for a number of years, I know it is going to be wrong.” But, he added, “The numbers are an illustration of where things are going.” And they provide grounding, he said, to “have a thematic discussion with our clients.”

People in finance are frequently well-informed, even if their specific predictions can’t be counted on. Bank of America’s year-end forecast is intriguing, for example. It signals trouble ahead in the U.S. stock and bond markets, predicting that the S&P 500 will be virtually flat over the next year. I wouldn’t give that claim much credence, because until September, Bank of America predicted that the S&P 500 would end this year at 3,800. When the market surpassed that level, the bank raised its 2021 “forecast” belatedly, with the benefit of hindsight.

But Bank of America’s perspective has been consistent in this sense: It is negative about the U.S. stock market.

In an online presentation on Monday, Savita Subramanian, the head of U.S. equity and quantitative strategy at Bank of America, said that the bank’s computer model for the S&P 500 “is now spitting out negative returns for stocks for the next 10 years.” The last time that happened, she said, was in 1999-2000, shortly before the dot-com crash. The current bull market has taken stocks to giddy heights and valuations are out of whack, she said. Over the long haul, that implies lower returns.

Having done many forecasts myself — some of which were on target, and others of which were spectacularly wrong — I understand what’s going on here.

The analytical thinkers here have models. The inputs for those models are things like economic growth, P/E ratios, interest rates, tax rates, and growth rates. If the predictions for the inputs are right, then the predictions for the stock values will be very accurate. They know, for example, what effect an increase of a quarter point in the Fed’s benchmark interest rate will have on stock prices, and their knowledge is very accurate because they have a lot of historical data to base it on.

The problem of course, is predicting the inputs. If you know what effect a war will have on stock prices, but you don’t know whether there’s going to be a war, then your predictions are going to be worthless.

But that model has worth. It’s not useless — it’s very useful. And to the extent that the model is off, there’s always data to make it more accurate every time it’s in error, which makes it more and more useful the longer you use it.

This is what Marcelo Carvalho of BNP Paribas means when he says the model provide grounding to “have a thematic discussion with our clients.”

Making those predictions publicly is not an actual forecasting exercise, it’s marketing.

The predictions get picked up as news — they generate publicity.

Jeff Somer sees them and says “See, those forecasters are full of crap.”

But the smart money sees them and says “Hmm, those guys have a model. If stuff happens, they’ll know how that will affect the market. Somebody with a model like that is worth working with.”

No one can accurately predict where the market is going because nobody can predict the unforeseen events that will move the market.

So their predictions will certainly be wrong. But that doesn’t mean they’re useless.