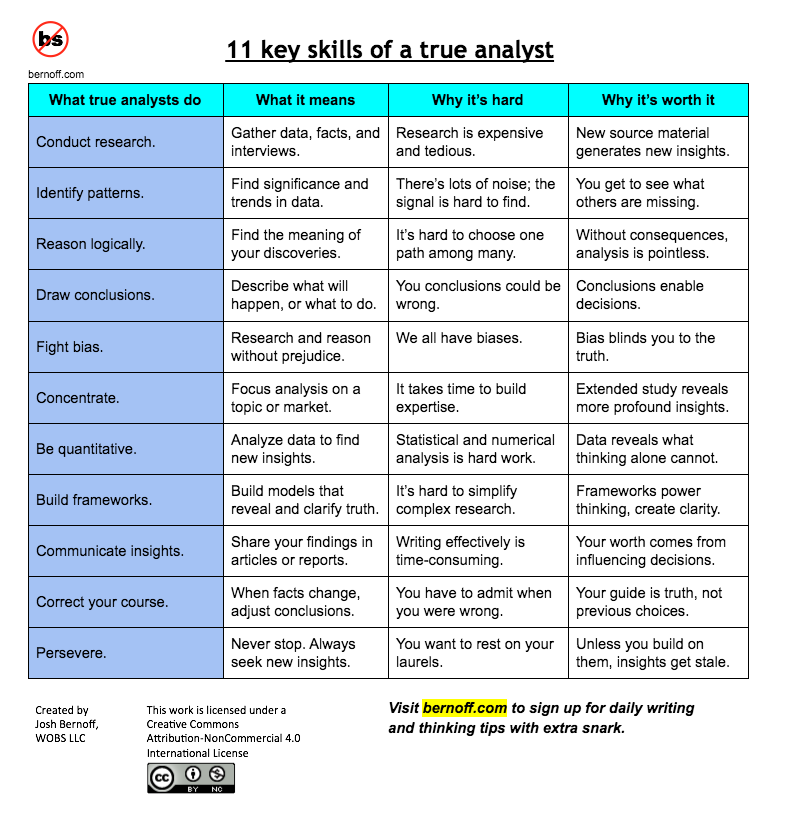

11 key skills of a true analyst

If you want clear and useful thinking, you need a true analyst, not just somebody who calls themselves an analyst. True analysts pursue thinking as a discipline. Let’s look at the qualities and skills that define that discipline.

If you watch TV or read the media, it seems like you’re always hearing from analysts — color analysts and Democratic and Republican analysts, for example. But what they do is not what I used to do as an analyst at Forrester Research. I feel more affinity for people like Nate Silver and Bill James that turn data into insights. So here’s my definition of a true analyst:

A true analyst uses research and rigorous reasoning to acquire insights and then communicates those insights in a meaningful way.

This definition includes business analysts working for a company, competitive analysts, financial analysts, and even CIA analysts. It also embraces some people that aren’t traditionally called analysts — like economists and social scientists. But it excludes most reporters and commentators.

The 11 key skills of true analysts

Decision makers need insights. True analysts provide them. If you want to be a true analyst, learn to do these things well (a wall-chart summarizes these at the end of this post):

- Conduct research. For your analysis to have value, you must see what others have missed. This requires research: not just reading stuff on the Web, but reviewing data and interviewing people. You need fodder to analyze. Without research, you’re just a person who says interesting things.

- Identify patterns. Finding patterns is crucial for an analyst. Here’s where you identify how black people are voting, how mobile is affecting advertising spending, or how North Korea is changing its behavior. Unless you see trends, you’ll have no platform on which to build your analysis.

- Reason logically. Clear thinking is crucial. Analysis is made of “if-then” statements: if social media changes buying behavior, then marketers need a social media strategy. Without clear reasoning, you can’t tell what the patterns mean.

- Draw conclusions. So you found something. Who cares? Tell us what will happen, and what to do. Unless you take reasoning to its conclusion, you’re of little value to decision-makers.

- Fight bias. If you’ve already decided your conclusion, why conduct research? Biased reasoning to predetermined answers has no relationship to the truth. True analysts always wonder if they’re wrong and seek information to disprove their conclusions.

- Concentrate. To truly understand a market like travel or a phenomenon like cloud computing, you need concentrated effort over time. Expertise comes from experience. That expertise comes in handy when things change; you’ll be able to spot how power is shifting and draw conclusions appropriately.

- Be quantitative. Feelings and intuitions are fine, but numbers are the acid test. What is the data telling you? Does it support your conclusion, or contradict it? There is truth in data; it is your job to find it.

- Build frameworks. Analysis requires new ways of thinking, which in turn demand thinking frameworks. Think of the economist’s model, the marketer’s segmentation, or the strategy analyst’s two-by-two matrix. Frameworks make meaningful thinking both more powerful and easier to communicate.

- Communicate insights. Thinking alone in a room is useless. You must get your insights in front of decision-makers — publish them within your company, for clients, in an academic journal, or on the Web. Communication creates influence and subsequently generates another key source of insight for true analysts: feedback.

- Correct your course. You’ve drawn conclusions. You may be wrong. True analysts seek both data that corroborates their conclusions and data that disproves them. Figuring out why and in what ways you’re wrong leads to more profound insights.

- Persevere. When are you done thinking? Never. Every insight leads to new questions. New questions lead to new research, which leads to new insights. The true analyst always asks: what’s next?

Even if you’re not a true analyst, learn to think like one. Train your mind this way and you’ll make better decisions. Seeking truth makes work worthwhile.

I notice that clarity isn’t one of the key skills. I’ve seen some analyst content that was almost designed to be confusing.

How can analysts be more intelligible when there’s so much pressure to use oblique terms and new acronyms?

Good point, Phil. I’d put that under “communicate insights” but clearly some communicate better than others.

“Analyst capture” happens when the analyst becomes entwined with the market they cover, leaving common sense and clarity behind.

I hadn’t heard of “Analyst capture” before. Sounds like the curse of knowledge.

https://en.wikipedia.org/wiki/Curse_of_knowledge

Well, Josh, you’re one of the best. But I would add another thought that I learned from another great analyst, Byron Miller. You need to look at things a different way. Call it a Contrarian View. Just to validate your thoughts, a good analyst should take a different view of the topic/product/company.

Because I analyzed your analysis, I must point out that “data” are plural….

Most people have given up on that by now.